The lockdowns of 2020 may have prompted individuals to set far more funds toward their environment, boosting earnings for home improvement merchants Lowe’s (NYSE:Minimal) and Dwelling Depot (NYSE:Hd), but the financial and housing availability crunches of 2022 are retaining them there.

Home furnishings, electronics and home workplace established-ups aimed at making residence a improved position to live and operate fueled 2020 purchasing, but with people going through rising costs of gas and meals, theyre heading to house enhancement retailers to manage repairs them selves and start off gardens. This is preserving advancement at Lowe’s and House Depot sturdy, making them both of those potentially worthwhile portfolio additions this summer time, in my view.

Each possibilities have rising dividend yields, building them desirable for price investors looking to make passive earnings as well. Right before you increase either of these residence improvement stocks to your portfolio, nevertheless, there are some disadvantages to take into account.

Lowes

Lowes (NYSE:Very low) is a home enhancement retail chain running in the U.S., Canada and Mexico. It gives goods for construction, servicing, repairs and remodeling. The housing market might be cooling a small from the highs of 2021, which may perhaps encourage tasks in the home youre in.

Revenues for the corporation have doubled in excess of the previous 10 years, and earnings for every share are predicted to improve all around 13%. Lowe’s has a dividend generate of 1.66%, and the organization has a very long observe record of soaring dividends. That could support sweeten the offer for investors.

Analysts charge Lowe’s a purchase, even though bulls believe the company faces challenges from soaring interest charges, offer chain problems and flattening housing selling prices. Its well worth noting that the median age of residences in the U.S. is 39 decades, an age when houses will require an expanding amount of servicing and could be candidates for remodeling.

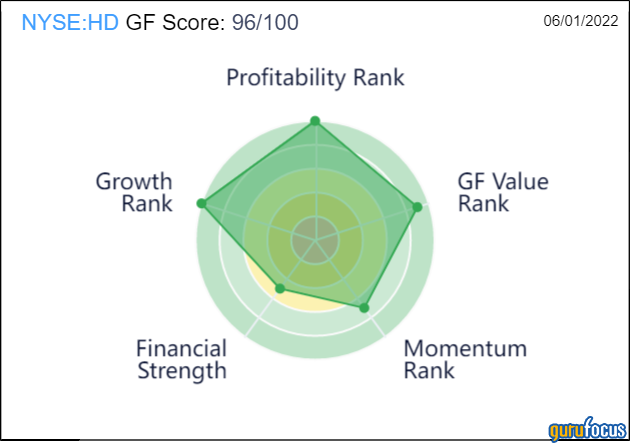

Lowe’s gets a GF Rating of 96, driven mostly by major scores for profiability and development.

Residence Depot

Surpassing forecasts in nine of the previous 10 quarters, another major U.S. dwelling enhancement retailer, House Depot (NYSE:High definition), just lately documented 10.7% growth in net income 12 months-above-calendar year.

Household Depot counts specialist contractors amid its largest shoppers, and their massive-ticket buys were up 18% in the course of the past 12 months. EPS has grown 17% over the past three decades and profits is up 8% over the previous year, having it a obtain rating from analysts.

Household Depot has a dividend yield of 2.26%, building it the far more eye-catching of these two shares for those in lookup of dividends.

Like Lowe’s, House Depot also has a GF Score of of 96/100. In addition to higher progress and profitability, it scores much better than Lowe’s for GF Benefit, however it loses points for weaker momentum.

This posting initial appeared on GuruFocus.

More Stories

Indicator & Then Inspect!

Should You Invest in A Single-Tenant or Multi-Tenant Property?

A Commercial Mortgage – Start Your Own Business Right Away Without Any Hassles!